The selection of Visa, Mastercard and PayPal to droop their offerings in Russia as a part of sanctions has drawn interest to the preparedness of the Indian economic machine to address such denial of service. While a number of the efforts to protect the financial system from oligopolies has borne fruit, India isn’t always insulated to the equal stage as China yet, in line with experts.

India isn’t anyt any stranger to sanctions or denial of offerings. The u . s . a . had confronted sanctions withinside the wake of the 1998 nuclear tests. Subsequently, Indian oil agencies coping with Iranian crude needed to take risks, with coverage agencies going through the second-order effect as they couldn’t get reinsurance assist for masking agencies that subtle Iranian oil. In latest times, insurers are uncovered once more as international reinsurers are refusing to offer a cowl for thermal strength flowers that use coal.

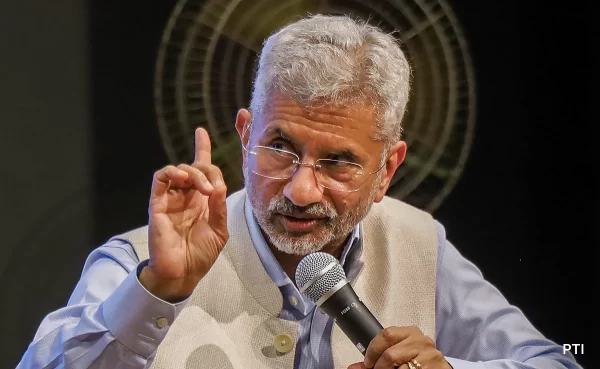

Capture

“In the fee world, India has constructed sizable functionality for the reason that release of the RuPay debit card below the NPCI, which approaches a long way greater transactions as compared to Visa/Mastercard,” stated a regulatory source. The ATM community is likewise insulated because it does now no longer depend upon international networks as all banks are required to be individuals of the home community. Similarly, account-to-account transfers thru the Unified Payments Interface (UPI) and the purchase of those transactions also are on home fee rails.However, with regards to credit score playing cards, the Indian marketplace is ruled through the Visa-Mastercard duopoly. While RuPay debit and credit score playing cards might paintings in India, cardholders might have a hassle with remote places transactions because the Indian card community isn’t always worldwide or nearby community like China’s UnionPay. In Russia, there are reviews that nearby banks will begin issuing playing cards on their home-grown Mir community at the side of UnionPay — China’s multinational fee community.

In India, the RBI has insisted on fee networks storing facts locally. Visa has complied with the guidelines after spending loads of hundreds of thousands of dollars. Mastercard keeps to stand a ban from the regulator from issuing clean playing cards. “However, facts localisation does now no longer suggest that continuity of offerings may be maintained if a multinational participant determined to withdraw,” stated the official.

Officials stated that as matters stand, withdrawal of offerings through fee networks might create a disruption starting from six months to three hundred and sixty five days in offering opportunity card networks to banks. On the fee reputation side, nearly all service provider obtaining banks sign on stores on all 3 networks inclusive of RuPay, which might suggest that there’s no disruption on the service provider-end. While UPI does now no longer have a cross-border dependency, fee apps owned through multinationals — Google Pay and PhonePe have a disproportionate proportion of UPI transactions.

Finally, a big a part of the fintech infrastructure in India that has been constructed through startups has been at the lower back of investment from multinational personal fairness firms. Incidentally, withinside the wake of the Russian crisis, a few fintechs have acquired queries from buyers on their publicity to Russia.